Are You Using a Modern Card Issuing Platform?

Is your organization ready for the next decade of the card market? Dreaming up eye-catching products is one thing. Making them a reality is another.

If you’re not using a modern card issuing and processing platform, then you’re putting yourself at a disadvantage. While many financial institutions (FIs) launched their products using legacy systems from decades ago, that technology isn’t getting any younger. Legacy technology was purpose-built for 20th-century use cases, making it difficult, if not impossible, to pivot towards new customer trends. As the market continues to grow and expand, old technology will continue to show its age as consumer-demanded features outpace the capabilities of old infrastructure.

.png?width=824&height=508&name=24-0065%20Consumer%20cred%20inline%20chart%20(1).png)

1. How easy is it to design and launch new products?

When it comes to cards, the only constant is change. Each generation expects more from their cards: more features, more convenience, more benefits. To keep up with this demand, you need to maintain a steady lineup of product development so you can offer cards that will delight your customers. However, many older payments platforms can’t support this pace of innovation. They only support a specific, limited set of product types, meaning that implementing any new offering could require a wholesale code rewrite.

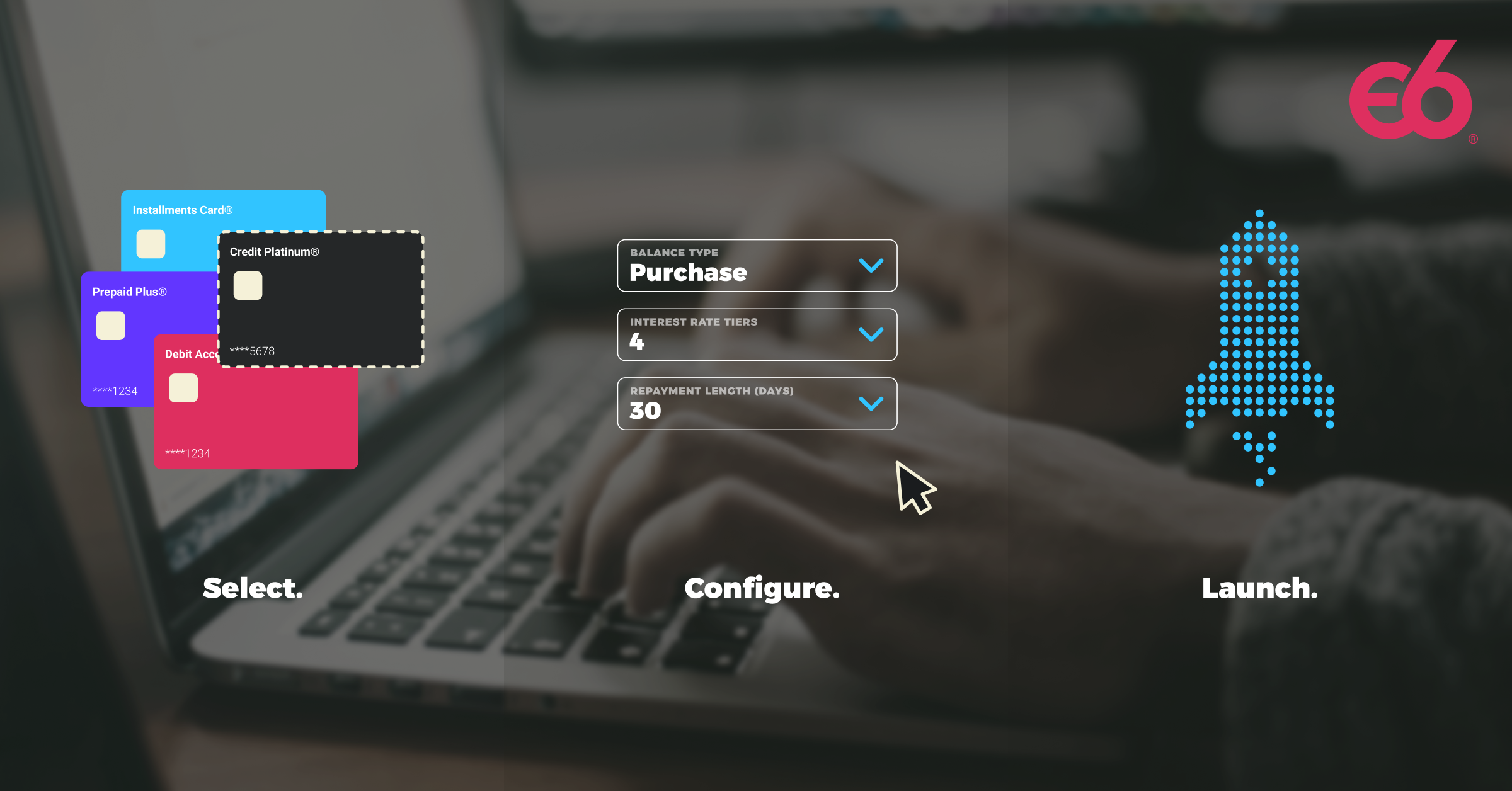

Modern platforms, meanwhile, are built with the knowledge that your success hinges on your ability to adapt to the market. A card issuing platform should be easily configurable, so you can design new products as the need arises, all without derailing your roadmap.

2. Can your platform easily add new features?

Even if you’ve already launched a successful card product, you can’t afford to let it stay stagnant. To continuously engage customers, you should be able to simply update and add features to your product. For example, you might find that you need to offer a special interest rate to incentivize a specific customer segment to sign up for your card.

Rigid legacy systems are commonly hard-coded to existing functionality, making it a tedious and time-consuming process to introduce additional features on existing products. An effective card platform should be configurable by design, letting you simply add, remove, or edit capabilities of each product as needed.

3. How well does your platform support mobile payments and digital wallets?

Digital-first isn’t a distant future anymore. It’s what customers want today. If your card platform was introduced before the era of Apple Pay or Google Pay, then you’re due for an upgrade to better support customer needs. A 21st-century card platform should enable digital wallet support through tokenization and compatibility with the most popular wallets currently on the market. This will not only enhance your security but will also cater to the increasing demand for mobile payments and digital wallet services.

4. Does your platform offer user-friendly experiences for both customers and internal users?

User experience is a critical piece of your organization’s success—for both your internal team as well as your customers. Your team members need an intuitive customer service UI so that they’re empowered to easily administer your product and support common customer queries. Meanwhile, customers should be able to manage most aspects of their account from a web app or digital experience without having to pick up the phone or walk into a branch. If your platform isn’t capable of enabling these features, then it’s time to upgrade.

5. Can your technology be customized to meet new and upcoming regulation requirements?

Regulations are ever evolving—especially in the card space. You should be able to accommodate your regulatory environment without undergoing tedious development cycles just to stay compliant. The inflexibility of legacy platforms often means that you have to devote months of valuable time on your development roadmap just to compliance updates. Instead, a digital-first platform should give you the configurability you need to easily make changes to your platform and remain compliant. With this accelerated compliance, you’ll be free to invest more time and resources into new product development and customer support.

6. How easy is it to embed your cards into third-party platforms?

Don’t limit your potential for business growth through card issuance. While directly issuing cards to your consumer cardholders is a sustainable way to develop your issuing portfolio, you can expand even further by embedding your cards into third-party platforms with a Cards-as-a-Service (CaaS) model. This approach not only provides seamless payment experiences for end users, but in the process, it also helps you extend your business reach by reaching new segments. Modern card issuance platforms can support CaaS models out of the box through configurable hierarchies and dynamic programs.

7. Is there robust analytics functionality to provide insights into product trends and behavior?

Data is the lifeblood of a good card product. You require reliable access to detailed information around customer behavior and account activity to power strategic decision-making. While legacy systems make it challenging to access necessary information through slow and tedious hardware, modern platforms deliver daily reports and on-demand API calls that allow you to access important data in real time. Being able to easily access and analyze this customer data can empower your organization to stay ahead of payment trends and understand customer behavior, enabling smarter decisions and better business moves.

Modern made possible today

Time for an upgrade? If you’ve gone through these questions and realized that your card platform can’t keep up with the market like it used to, then it’s worth finding a new card technology partner. Episode Six (E6) is here to help.

At E6, we provide an all-in-one solution for card issuing and processing. Our cloud-based and API-enabled platform can equip you with flexibility and agility to get ahead in the market. We take a progressive modernization approach to technology upgrades, so that you can build a modern card product on our system and run it as a sidecar to your core—allowing you to launch new offerings without disrupting ongoing operations.

Don’t let an outdated platform hold you back for the next generation of card products. Contact us today to see how E6 can empower you for the future.