Business Now, Pay Later Rising to the Occasion

The challenges facing both financial institutions and their SME customers boil down to one key component: working capital. SMEs struggle to maintain it, while FIs can face hurdles to provide effective access to it. Traditional invoice-based business loans are the conventional way of issuing and receiving credit for small businesses, but they can introduce cashflow issues.

Business loans often charge interest rates that can continually increase the cost of the loan depending on the length of the payment term. Additionally, rigid payment terms can fix loan repayments to specific schedules, which might not be viable for each SME’s unique needs.

Considering these issues, an ideal cashflow solution should feature two primary characteristics. First, it should be flexible enough to account for each business’s unique needs and payment terms. Secondly, it should be adaptable enough for the lender to implement once without having to customize its products for every client.

To see these principles in action, look to the business-to-consumer (B2C) space. The Buy Now, Pay Later (BNPL) model has proven extraordinarily popular in B2C payments—a study by C + R Research found that 60% of global consumers reported using a BNPL service in 2021 alone. Financial institutions can leverage this market for success by applying BNPL in the business-to-business (B2B) space.

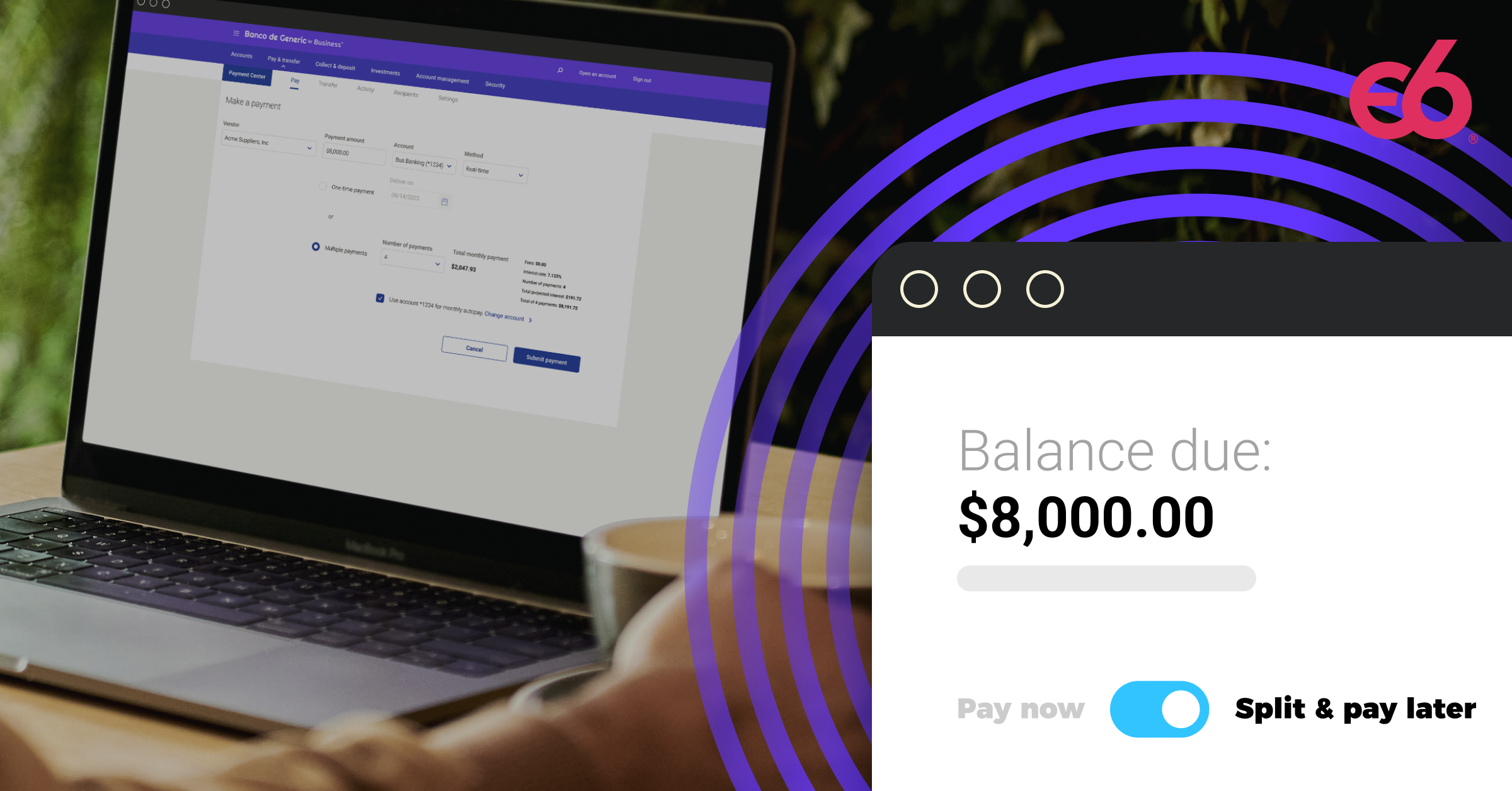

Like their consumer counterparts, B2B BNPL loans involve a business paying off the cost of a purchase over time with installment payments, rather than paying the full sum at once. Compared to traditional loans, B2B BNPL solutions set themselves apart by offering versatile ways for SMEs to pay.

Some key benefits of B2B BNPL loans for SMEs:

-

Flexible repayment:

B2B BNPL loans typically provide more flexibility in repayment terms. Instead of fixed monthly payments required by conventional loans, BNPL allows businesses to choose from a range of payment schedules that align with their projected cash flow. This flexibility can help businesses manage their finances more effectively. -

Quick approval and disbursement:

BNPL loans typically have faster approval and disbursement processes compared to traditional loans. This speed can be crucial for businesses needing to make time-sensitive purchases or cover unexpected expenses. -

Easy application:

Applying for a B2B BNPL loan tends to be simpler and more streamlined than the often lengthy and paperwork-intensive process of securing a conventional loan. Many BNPL loans can even be authorized directly at the time of the transaction, allowing near-instant access to credit when needed. -

No interest or lower interest:

Many B2B BNPL providers offer interest-free financing for a specific period or lower interest rates compared to traditional loans. This can lead to cost savings for businesses. -

Predictable costs:

With fixed payment schedules, fees, and interest rates, BNPL loans make it easy to predict exactly how much a loan will cost before funds are even disbursed. Compare this with traditional loans that continue accruing interest and getting more and more expensive over time, and BNPL loans present an appealing proposition for SMEs. -

Credit building:

Timely repayment of BNPL loans can help businesses build their credit profiles. This can be particularly beneficial for startups and small businesses looking to establish a strong credit history.

To learn more about Business Now, Pay Later, contact E6 today.