What is a card?

Cards have come a long way since their humble beginnings as pieces of cardboard with embossing. They evolved into plastic, received magnetic stripes, then chips, and now they can be digital tokens that live entirely on your phone. But no matter what form a card takes, its job is the same: facilitating secure, real-time payments.

At its core, a card is simply an access mechanism to an account. The card details, including the PAN, are like a key to the door of your bank account. The exact details of a card are like a perfectly cut key shape, without which you can’t unlock access to an account. Whether it’s withdrawing cash, making an online purchase, or tapping at a point-of-sale terminal, the card unlocks the transaction between payer and payee.

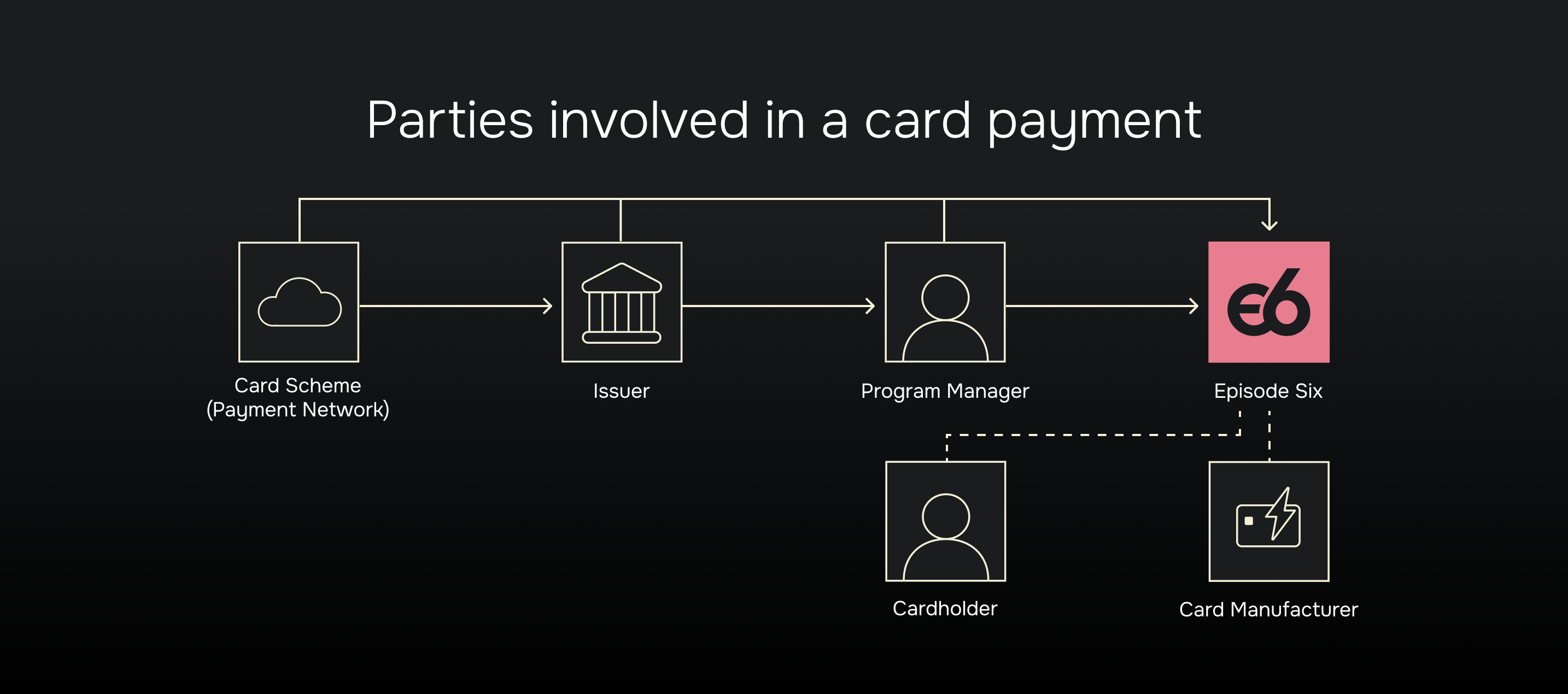

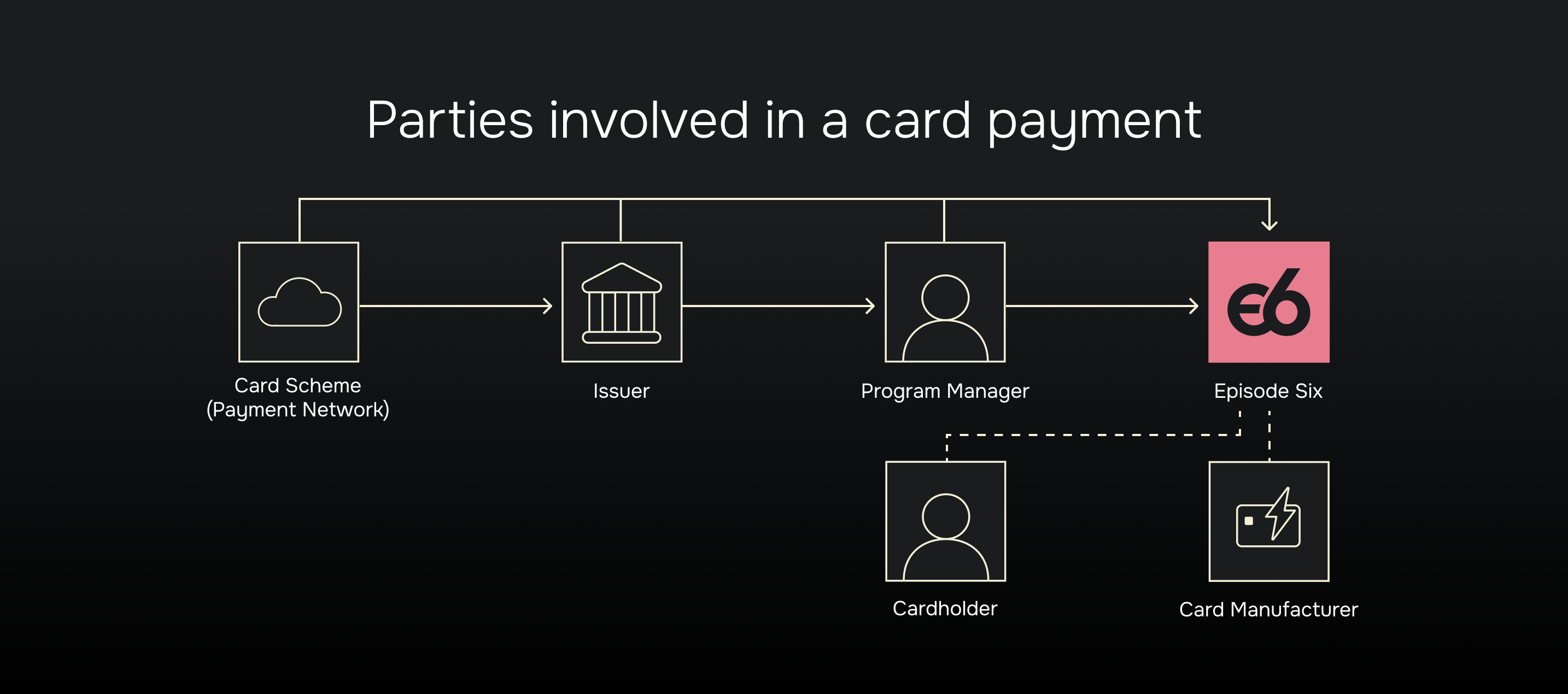

The involved parties of a card payment

A card payment might seem simple, but there are multiple entities involved in the transaction.

Cardholder: The payer in a given transaction, and the owner of the card.

Merchant: The payee in a given transaction.

Acquirer: The bank that is processing the payment and accepting funds on behalf of the merchant. Also called an “Acquiring Bank” or “Merchant Bank”.

Issuer: The bank that holds the funds of the cardholder and will send those funds to an acquirer when a card payment is requested. Also called an “Issuing Bank”.

Card Network: The provider of connectivity between acquirers and issuers both in terms of physical infrastructure and payment processing. Also called a “Card Scheme”.

The basics of a card payment

When you use a card for a purchase at a venue such as a physical store, the following sequence of actions takes place within seconds:

- The cardholder presents the card to the merchant’s point of sale (PoS) terminal.

- The merchant PoS system sends the purchase and card details to the acquirer.

- The acquirer generates a card payment request and it is sent to the card network.

- The card network routes the card payment request to the correct issuer.

- The issuer authorizes the card payment and generates a card payment response with the decision.

- The card network returns the response to the acquirer.

- The acquirer forwards the response to the merchant.

- The cardholder is informed of the result of the card payment.

How card payments are funded

Card payments can be funded in three different ways which define the common names of card “product” types.

| Product Type |

Funding Approach |

Issuer Risk |

Interchange |

| Prepaid |

The issuer is paying on behalf of the cardholder, but the cardholder funds are already held by the issuer. |

There is nearly no risk for the issuer as the funds have already been paid to issuer before the card payment is made. |

Earn minimal interchange fees. |

| Debit |

The issuer is paying on behalf of the cardholder, but draws against funds held by the cardholder in the associated accountin real-time. |

There is little risk for the issuer because they confirm the available balance of the account before authorizing the payment. |

Earn minimal to moderate interchange fees depending on the market. |

| Credit |

The issuer is paying on behalf of the cardholder, and the cardholder will repay the issuer at a later time. |

There is some risk for the issuer because the card payment is authorized against a credit limit, but there is no guarantee of being paid back. |

Earn higher interchange fees regardless of market. |

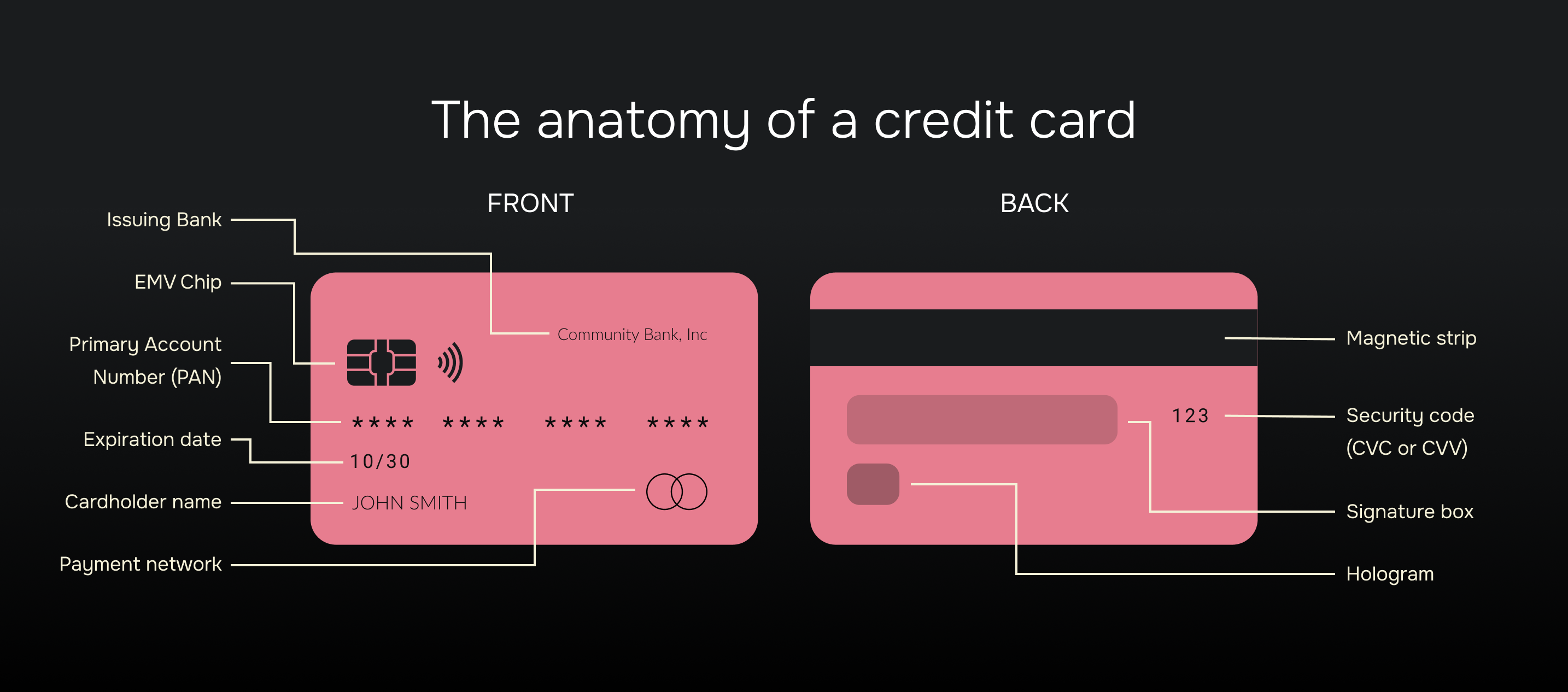

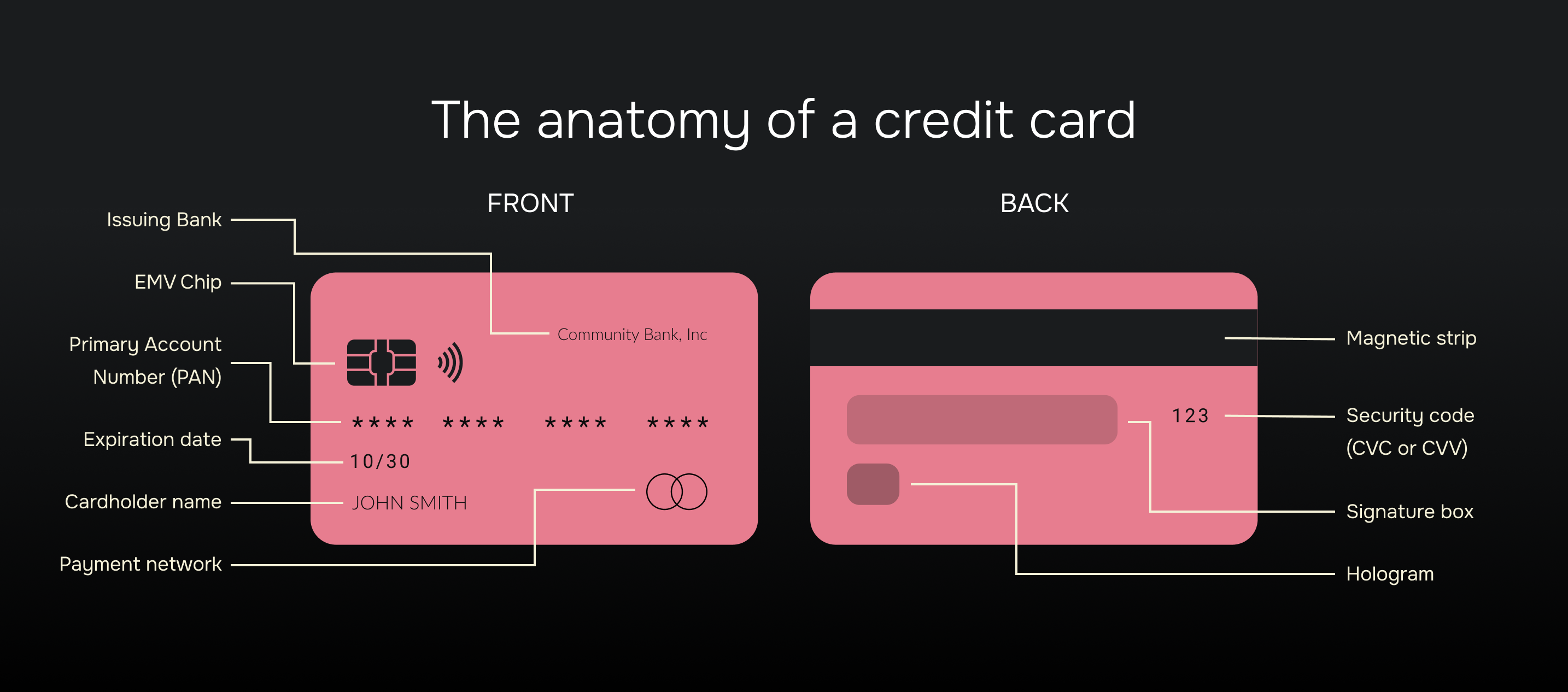

The basic anatomy of a card

Every card contains specific data elements that help process and secure transactions:

Primary Account Number (PAN): The 16-19 digit number on the front of a card, used to identify a card. Ultimately this is what is used to tie a card to an account by the cardholder's bank.

BIN (Bank Identification Number): The first 6-8 digits in the PAN which identifies the card issuer and is used for routing card payment requests to the correct issuer.

Expiration Date: An added security feature, ensuring the card remains valid only for a specified period, captured as a month and year in a future date from issuance.

Cardholder Name: The name of the owner of the card.

Security Code (CVV/CVC): A unique 3-4 digit number generated at the point of card issuance used primarily for online transaction. This changes when a card is reissued with the same PAN.

Service Code: Specifies the allowed uses of the card, for example: ATM-only, international usage, PIN-required, etc.

The many shapes of cards

Cards come in various forms. While virtual and tokenized cards are becoming more common, physical cards remain an essential component of the payments ecosystem.

Physical Cards: A literal card which is typically made of plastic or metal, and is kept on the cardholder’s person. They can be swiped, inserted into a chip reader, or tapped using contactless technology.

Virtual Cards: A digital-only representation of a card, often used for online purchases or remote payments. These can be either a standalone virtual-only card or a virtual version of a physical card.

Tokenized Cards: A further abstraction of a card, where the card details are replaced with a unique digital token that is either device- or merchant-specific. Tokenized cards power digital wallets like Apple Pay and Google Pay.

How Episode Six can help you launch any card you want

Whether you're looking to add a card to an existing product, or launch a new type of card, Episode Six can make it happen.

We specialize in helping financial and non-financial technology companies expand into the card space. We offer the modern technology and support you need to:

- Launch prepaid, virtual or physical cards for consumers or business. Add any configurations and controls you want, from spend to location, rewards and interest.

- Launch quickly and efficiently, without being bogged down by legacy systems.

- Customize your offering, whether you’re targeting consumers with cash back rewards or businesses with corporate expense tracking.

- Take control of your program from day one, with minimal reliance on third-party service providers.

Ready to get started? Contact us today.

About Episode Six

Episode Six is a global provider of enterprise-grade card issuing and ledger infrastructure for financial technology companies, banks, and brands. Episode Six delivers the innovative capabilities needed to compete with disruptors and lead the market. Flexibility, adaptability, and resilience are built into the core of Episode Six's platform, ensuring clients maintain a market-leading position. Episode Six operates in over 45 countries, powering 70+ enterprise customers globally, with an expanding team located in the US, Canada, UK, Europe, Japan, Singapore, Hong Kong, Australia, and India. Investors include HSBC, Mastercard, SBI Investment Co Ltd, Anthos Capital, Avenir, and Japan Airlines.