Episode Six and DCS Card Centre partner to launch Credit Cards-as-a-Service for fintechs

.png)

- Starting with Singapore, this move will pave the way for the service to be rolled out to other APAC markets

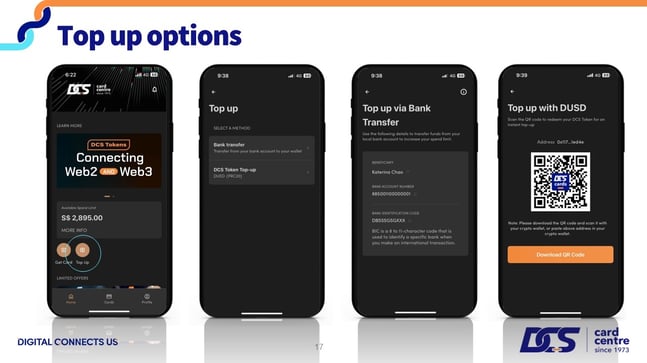

- The solution also includes access to a virtual account that enables top-ups with digital assets via DCS tokens (see image below)

SINGAPORE, 23 APRIL 2024 – Payment processing provider Episode Six (E6) has announced a partnership with Singapore-licensed financial institution DCS Card Centre (DCS) that will enable fintech companies to issue their own branded credit cards through their own customer interface.

Powered by E6’s card issuance technology, the process required to launch a new credit card is now significantly reduced from the typical four – six months to a matter of weeks. This collaboration between DCS and E6 combines their respective expertise into a unified platform, streamlining this process which is traditionally complex and tedious due to regulatory, operational and technical challenges, to allow fintechs to innovate rapidly.

In its endeavour to provide integrated payment experiences to consumers and corporates, this holistic solution also incorporates access to a virtual account that enables top-ups with fiat currency via bank transfers, or with digital assets via DCS tokens, which are directly issued by DCS.

Starting with Singapore, this move will pave the way for the service to be rolled out to other markets in the Asia Pacific region.

John Mitchell, chief executive officer (CEO) and co-founder of Episode Six, said: “Fintechs and other companies that leverage this solution will be able to reap all the benefits that a modernised cloud-native payment system can provide - resilience, scalability, and security”.

This strategic partnership serves as a key business pillar of DCS Innov, a new enterprise established by DCS in February 2024 to drive digital innovation in the fintech sector.

CEO of DCS Innov, Ceridwen Choo, who led the new business initiative shared that this partnership with E6 is a deliberate effort to build a strong foundational infrastructure that will support the company’s vision in leading embedded payments in Singapore and the region, with a simplified access to integrated payment services.

“Embedded finance, especially card payments, is top-of-mind for fintechs wanting to scale their businesses. E6’s robust APIs and presence in major countries globally, is well-placed to support fintechs and any other brands wanting to incorporate payments into their digital interfaces,” said Ms. Choo.

Added Mr. Mitchell: “Embedded finance is changing the way we interact with financial services and drive innovation in the industry. This trend is redefining the traditional landscape, enabling banking functionalities to be woven into the fabric of our digital interactions. In today’s digital era, relying on legacy payments technology can prove costly in the long run and financial institutions will do well by adapting to stay relevant.”

About Episode Six

Episode Six (E6) is a global provider of enterprise-grade payment processing and digital ledger infrastructure for banks and companies looking to offer payments to their customers. E6 delivers the innovative capabilities needed to compete with disruptors by augmenting existing infrastructures. Flexibility, adaptability, and resilience are built into the core of E6’s TRITIUM® platform ensuring clients maintain a market-leading position. E6 operates globally across 40 countries with an expanding team located in the US, Europe, Japan, Singapore, Hong Kong, and Australia. Investors include HSBC, Mastercard, SBI Investment Co Ltd, Anthos Capital and Avenir. For more information, visit www.EpisodeSix.com or LinkedIn.

About DCS Card Centre

DCS Innov is an independent enterprise set up by DCS Card Centre, to revolutionise the payments landscape by fostering innovation in the sector. This initiative complements the operations of DCS and accelerates its ambition to be the leader of next-gen payments through the co-creation and incubation of forward-thinking solutions through partnerships. At DCS Innov, we are committed to pushing boundaries, cultivating an environment of collaboration and synergy for innovation, and leading meaningful change by pioneering cutting-edge solutions that seamlessly integrate across diverse facets of the payments ecosystem. For more information, visit https://dcsinnov.com/