Deliver better solutions for banking customers: Q&A with Dan Phillips

Today’s customers want more from their banks. While previous generations might have been content to accept the same generic credit, debit, and savings products, the explosion of technology transformation over the past few decades has driven demand for more innovative products. This poses a challenge for banks. What can your organization do to meet customer needs?

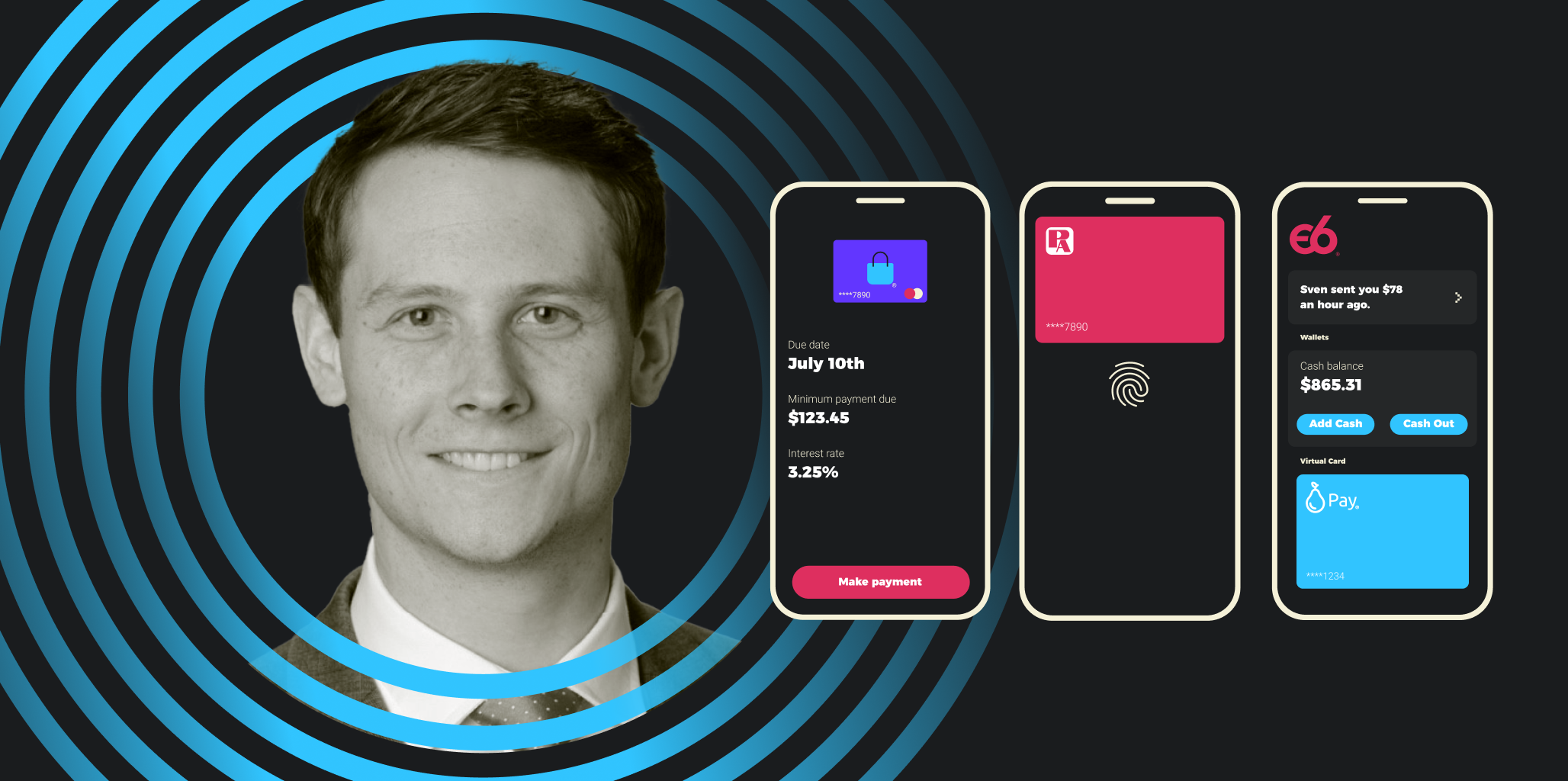

To learn more, we sat down with Dan Phillips, Sales Director at Episode Six (E6). Dan has 14 years of international experience in the banking industry and has worked in customer-facing and operational leadership roles, where he’s focused on meeting customer needs with market-leading propositions. In this discussion, Dan explores some key banking trends and identifies a new way for banks to build better customer offerings.

How are financial services addressing new customer demands and trends?

Moving money is central to everyday life. People and businesses want to make that exchange as seamless as possible. It's about providing payment at the point of need: at any point in a journey, whether that’s in an app, website, or physical store, you can make the payment in whatever way is most convenient to you. As such, there’s a need for financial services innovation to make things easier, cheaper, and more accessible for end users.

What challenges are banks facing as they capitalize on these trends?

Within the past few generations, we’ve gone from paper payments to electronic transfers. But the way those experiences are designed are still the same. A payment is still moving money between people via a bank instrument. Many banks still use core systems built in the 1970s and 80s, so few have been able to drive true innovation in banking products and services.

Customer demands have continued to evolve, however. That’s why traditional ways of thinking about banking aren’t as relevant as they once were. Rather than continuing to do things the way they’ve always been done, it’s crucial for banks to carry forward an innovation mindset to solve for customer needs.

How can banks upgrade their core technology to drive innovation?

Fully replacing your core simply doesn’t work. The industry moves so quickly that by the time you complete a core replacement, your technology’s already outdated again. What was meant to be a “future-proof solution” is now considered legacy tech in five years’ time. That’s why progressive modernization is critical.

In this approach, you implement modern technology for new product development while keeping your core for vital functions. By decoupling your products and services from the core, you can start introducing next-gen capabilities without having to embark on a rip-and-replace project. With cloud-native technology, you can easily launch modern products like virtual accounts, BNPL, digital wallets, and tokenized cards—all of which are difficult to create on mainframe legacy cores. With this approach, it's far quicker to get to market with solutions that customers demand.

Can banks balance innovation with regulation and security?

Absolutely, and there’s plenty of innovation underway in the areas of regulation and security, too. Banks have long had to comply with regulatory requirements and have become adept at doing so. In today’s changing landscape, security and fraud threats are more prevalent than ever, and risk management solutions have had to evolve to keep pace and protect both consumers and the financial ecosystem. We’ve seen a growing trend for banks to partner with best-in-breed compliance and risk management providers (particularly in areas like fraud monitoring) that augment their existing controls. However, this doesn’t need to get in the way of product innovation.

Similarly, in the compliance and risk management space, there is a proliferation of fintechs that are focused on providing very specific, best-in-class solutions. If banks want to create compelling solutions for their customers (both consumers and businesses), they need to think beyond iterative development of existing products and platforms. Instead, banks should harness the power of partnerships to design products and experiences their customers will love. If these propositions are built on a modern tech architecture instead of legacy systems, they can also often be embedded in third-party platforms, allowing banks to access new distribution channels and reach new customer bases.

How can banks design better customer-focused products?

Start with the customer. What day-to-day challenges do they face when moving money between people or financing a business? Look at things differently, instead of settling for the status quo. By selectively modernizing your technology and leveraging real-time data, you can better understand customer needs and create better products in the process.

Take small or medium enterprises (SMEs), for instance. Traditional financing methods often rely on slow and outdated technology that can’t keep up with rapidly growing businesses and deliver the working capital they need. By leveraging improved data availability through cloud-based infrastructure and API-enabled platforms, banks can be better equipped to provide faster and more convenient solutions that solve pain-points of SME customers.

In the consumer space, think about how payments fit into everyday life. For example, parents need ways to easily manage their children’s spending. With configurable virtual accounts, banks can define hierarchical relationships between parent and child accounts. This allows banks to offer prepaid cards to families, which give parents full control over elements such as the card’s spending limits and eligible merchants. This solution offers financial empowerment to younger cardholders without posing additional risk to parents.

Better payment solutions for real-world problems like these are enabled by modernizing the banking tech in the background.

Learn more from Dan and other E6 thought leaders in the full Progressive Modernization Playbook. And if you want to speak with Dan or another member of the E6 team, contact us to learn more.

E6 Team

About the Author

Episode Six provides financial institutions with solutions for legacy payment stacks that aren’t fulfilling the needs of an expanding industry. We are a global provider of enterprise-grade payment technology and ledger management infrastructure for banks that need to keep pace with disruptors and evolving consumer preferences.