Key benefits of card tokenization for businesses

.png)

What is card tokenization?

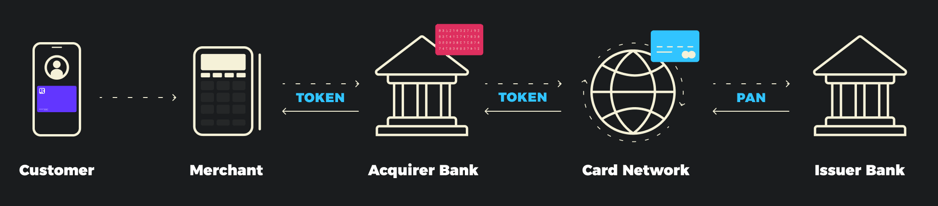

Card tokenization is a powerful method to strengthen payment transaction security. In short, card tokenization converts sensitive card information, such as the primary account number (PAN), into non-sensitive and randomized tokens.

In the event of an online security breach, hackers can only access encrypted tokens instead of valuable card information. For physical breaches, tokens are protected by device security features like face recognition or fingerprint which add an extra layer compared to traditional cards.

When a transaction occurs the token is transmitted through the payment network, processed by the appropriate parties, and eventually mapped back to the original card data within the secure tokenization system. This seamless process allows for a secure and streamlined transaction without exposing sensitive card information to potential vulnerabilities.

3 key benefits of tokenization

Every year, the cost of a data breach increases. According to IBM, the average cost of a data breach in 2022 was $4.35 million, and the United States had the highest average cost at $9.44 million. But the benefits go beyond risk avoidance. Card tokenization significantly enhances the security of payment transactions and simplifies the payment experience for merchants and customers.

-

Enhanced security

One of the primary advantages of card tokenization is its heightened security. By replacing sensitive card data, tokenization significantly reduces the impact of data breaches and unauthorized access. Even if a token is intercepted or compromised, it holds no value without the original card data. Tokenization also protects against card skimming and cloning, as the actual card information is not exposed during transactions, mitigating the risk of fraudulent activities. -

Compliance with data security standards

Maintaining compliance with data security standards, particularly the Payment Card Industry Data Security Standard (PCI DSS), is crucial for businesses that handle cardholder data. Tokenization aids in meeting these compliance requirements by reducing the scope of sensitive data storage and transmission. By removing the need to store actual cardholder data, businesses can minimize their risk exposure and simplify their compliance efforts. -

Simplified payment experience

Card tokenization offers customers a streamlined and simplified payment experience. Tokenization enables seamless checkout experiences, as customers can make purchases without repeatedly entering their card details for each transaction. Whether in-person, online, or via mobile payments, tokenization simplifies the payment process, improves efficiency, and enhances customer satisfaction..png?width=720&height=405&name=Untitled%20design%20(24).png)

Card tokenization with E6

E6 provides card tokenization and token management for cards issued on the E6 TRITIUM® platform. Card tokenization and token management are enabled by exposing connections to token service providers, including Mastercard’s MDES and Visa’s VTS.

E6 enables card tokenization right at issuance meaning customers can instantly access their funds and begin spending on their new digital cards. E6 offers various provisioning methods, including push (in-app) provisioning and manual provisioning. Push provisioning allows tokens to be added to digital wallets through the issuer's user experience, while manual provisioning occurs within the token requestor's experience.

Made for your favorite digital wallet

E6 supports popular digital wallets, including Apple Pay, Google Pay, and Samsung Pay, offering seamless integration and enhanced security for card tokenization. With advanced card tokenization and token management capabilities, cards issued on our digital wallet platform can be easily tokenized and used for secure contactless payments.

Whether it's the convenience of Apple Pay, the widespread reach of Google Pay, or the compatibility with Samsung Pay, E6 ensures that customers can enjoy the benefits of these popular digital wallets while keeping their payment information safe and protected.

Interested in learning more about our tokenization capabilities and how E6 can help bring your roadmap to life? Chat with our team today.