Should you be thinking about issuing cards?

Hint: probably!

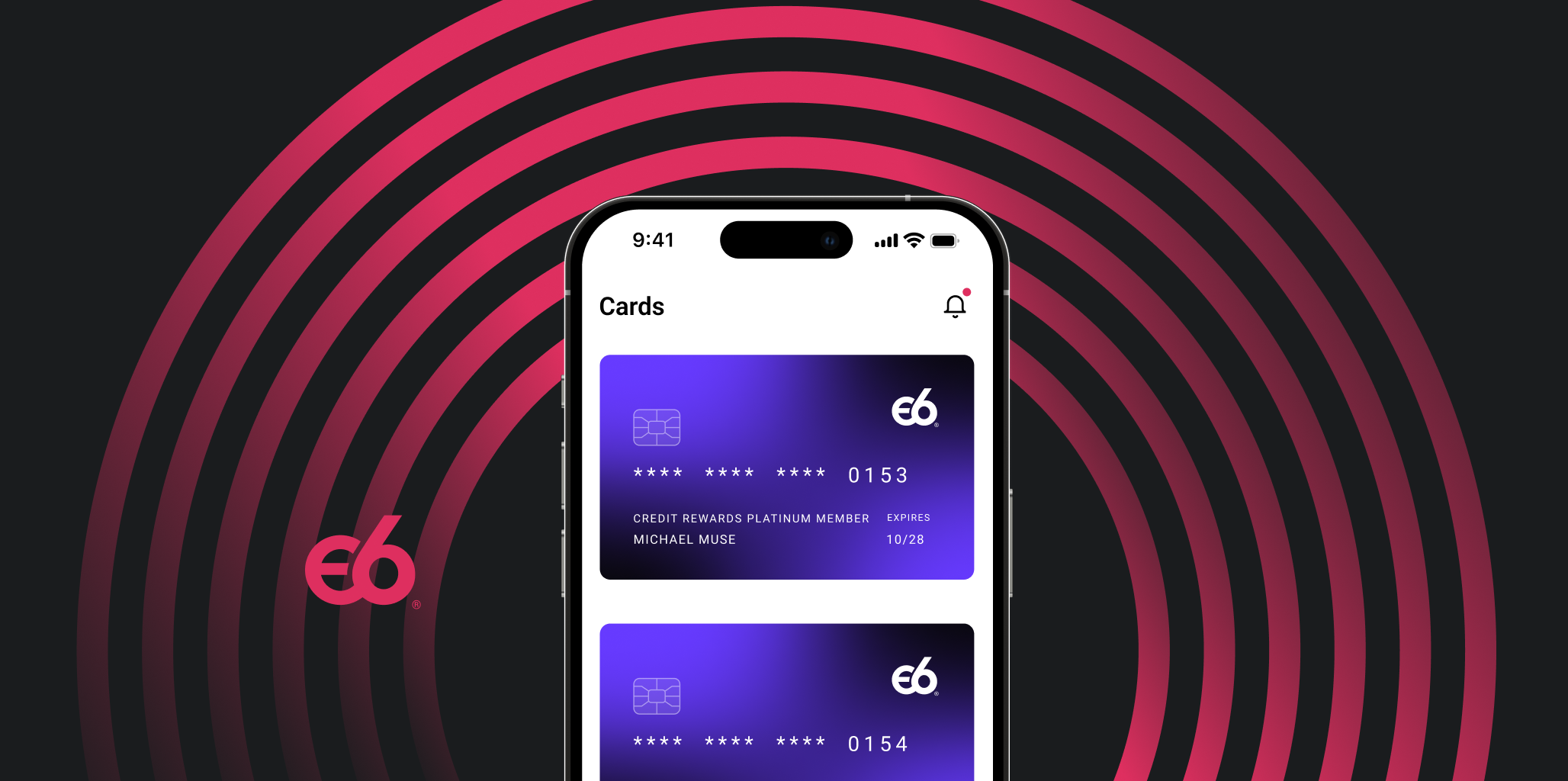

If you’re a financial or non-financial technology company and haven’t thought about offering your own branded debit or credit card yet, you’re leaving money on the table. The card-issuing game isn’t just for banks anymore. It’s for any company with an engaged customer base, a slick app, or a loyalty program. Let’s break it down:

- Neobanks & Digital Lenders: If you’re in the digital banking space and your customers already trust you with their money, why not add debit/credit cards into the mix? Cards are a no-brainer extension of what you’re already doing.

- B2B2X Providers: Are you already proving financial infrastructure or BaaS? You can introduce a Card-as-a-Service offering to enable your clients to offer their own branded cards to their users.

- Financial Management Solutions: If you’re helping companies and contractors manage their business accounts and expenses, you’re in a fantastic position to offer cards to provide an integrated offering streamlining financial management.

- Payment & Wallet Providers: Are your users keeping money in your wallet? Slap your logo on a card and let them start swiping—those tiny fees (more on that later) will stack up fast.

- E-commerce Players & Marketplaces: Imagine the kind of loyalty and extra revenue you can create by offering a branded card that gives customers perks every time they shop on your platform.

- Gig Economy Platforms: If you’re serving freelancers or the gig workforce, offering fast access to earnings via a debit card will make you the hero of the day.

- Retailers & Brands with Hardcore Fans: You’ve got brand lovers who’ll buy anything with your name on it. Why not give them a credit card with sweet rewards and discounts they can’t resist?

Ready to learn what adding cards can do for you? Download our 3 Key Benefits of Adding Cards to Your Offerings ebook today to learn how cards can transform your business.